gst on commercial property sale malaysia

When a corporation purchases a property for commercial activities such as business rental or development they can defer the GST paid on the purchase price. It emphasizes on the RENTAL though.

Account Executive Job Description Updated For 2022

Section 221 of the Excise Tax Act allows the seller to not have to collect the GST on the sale.

. Guide for Property Developer for issues related to the nature of your business. Only revenue of Rs. 12 with ITC unchanged.

For all commercial property rentals the rent is a taxable supply of service and the GST applicable on it is 18. Instead of beating around the bush there is a clear pricing scheme for properties of these kind where there is a segregation between the. Your residential status will also affect the rates that apply.

GST Rate in effect till 31st March 2019 GST Rate from 1st April 2019 onwards Residential Property non-affordable housing segment 12 with ITC. Property sellers will have to pay a 6 GST which is calculated from the gross selling price to. Browse genuine industrial property listings with a peace of mind.

Goods and services tax GST applies to the supply of certain property types if the seller vendor is registered or required to be registered for GST purposes. The rent on the rooms is less than Rs10000. New guidelines were issued recently by the Royal Malaysian Customs Department that includes more people being required to pay the Goods Services Tax GST when selling a commercial property The Star reported.

May 4 2016. However the corporation must be registered for GST on or before the completion date. So it is wise to transfer your commercial title holder to individuals if you are a registered GST entity company before 1April2015.

Any type of immovable property rented out for commercial purposes however would be subject to an 18 GST. The rental price of the shops and other business spaces is. Depending on certain conditions being met as determined by the Director-General of Customs DGC a sale of a commercial property may be subject to GST.

Thanks for the source but the paper does not spelled out clearly on the SALE of commercial property from a non-GST entity. As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules. This means GST is charged at either 0 or at 15.

Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST. Be mindful about the Goods and Services Tax Gst Commercial property investors take note. If youre going to sell a commercial property and youre registered for GST the sale will be a taxable supply.

Type of Real Estate Property. By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject.

Anyway great effort bro. The sale and lease of properties in Singapore are subject to GST except for residential properties. If sold within 3 years.

The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an. GST has however made things simpler for landlords of commercial real estate. Property sector still grappling with GST issues.

2 At a glance 21 The sale and lease of all properties in Singapore are subject to GST except for the sale and lease of residential properties which are exempt from GST. Residential homes are excluded from GST under the current rules. Commercial property is defined in the A New Tax System Goods and Services Tax Act 1999 GST Act.

The rate youll use depends if there are existing tenants in the property youre selling. GST is also chargeable on the supply of movable furniture and fittings in both residential and non-residential properties. Ad Our professional sales agents will assist you to find your ideal factory or warehouse.

22 Where the sale and lease relates to a mixed-use property GST is chargeable. Calculation of GST on commercial property rentals. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business.

GST is at 0 when the property has existing tenants. While there may be some similar features between. GST is 0 if the commercial property has.

24 February 2016. Real estate agents must charge GST on the brokerage fees received from the real estate agencies. Capital gains tax is referred to as RPGT in Malaysia and differs depending on your holding period and whether you buy residential or commercial property.

20 lakhs or more is now subject to the GST on commercial rental income. RPGT increases progressively as follows for commercial property. If sold before 4 years.

GST and commercial property.

Tax Base Definition What Is A Tax Base Taxedu

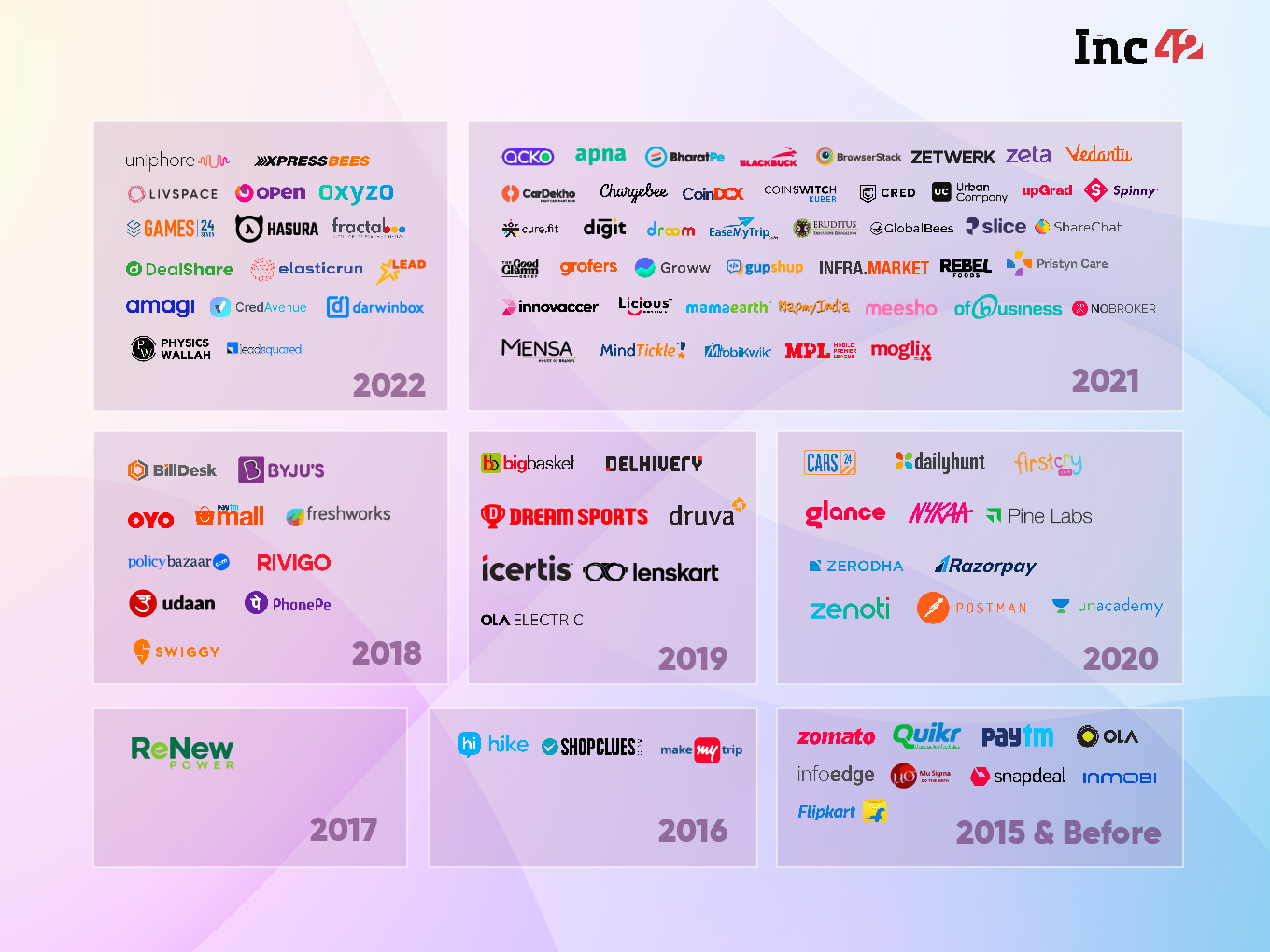

Unicorns In India The List Of Indian Startups In The Unicorn Club

Checklist Check These 5 Legal Documents Before Buying Ready Flats Property

Property In Shree Nagar Mumbai 14 Real Estate Property For Sale In Shree Nagar Mumbai

Gst On Flat Purchase And Real Estate Rates In 2022 And Impact On Home Buyers

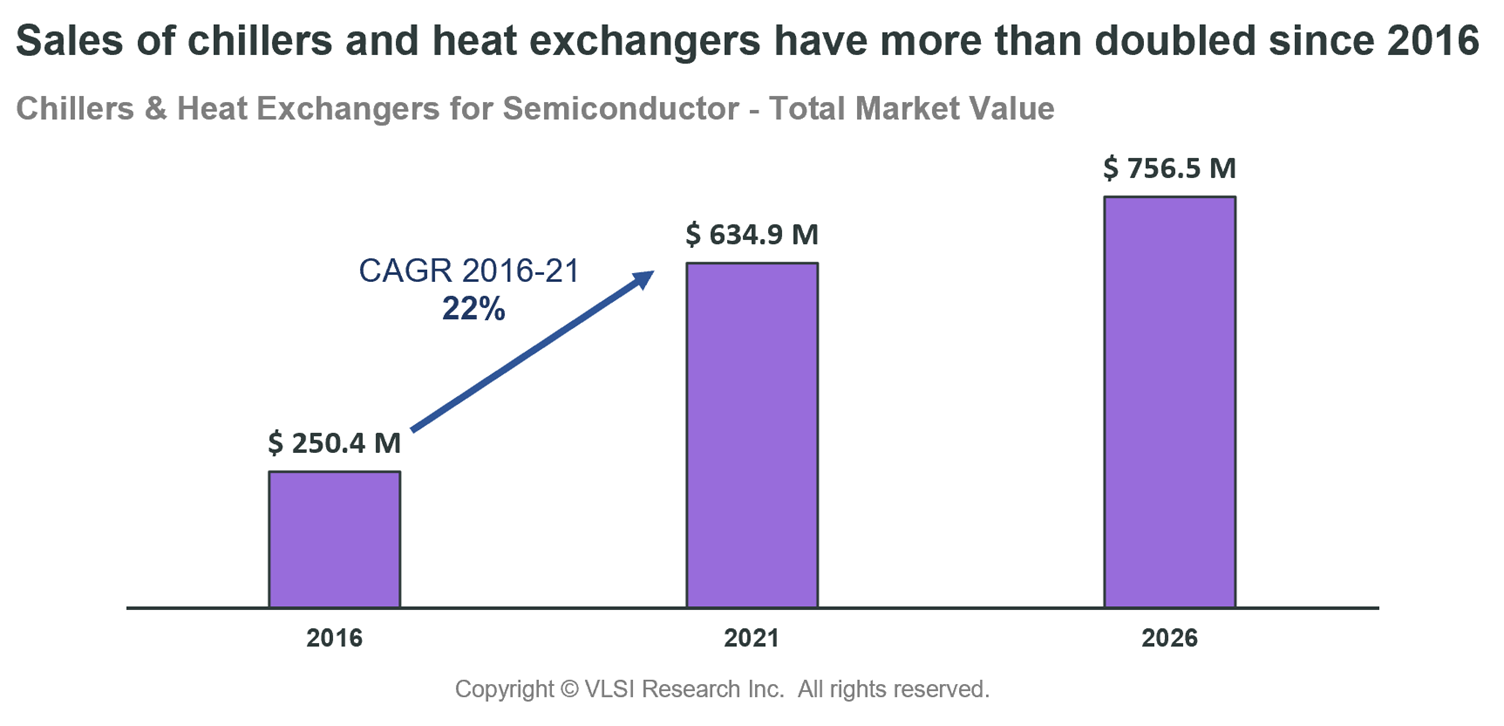

Chillers A Cooling Product But Temperatures Still Rising Semi

Special Assessment Tax Definition

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Is It Time To Reithink Your Investments

Gst On Houses Reduced 1 For Affordable 5 For Under Construction

Real Estate Accounting Software Sage Canada

Property Tax Details Revealed Tax Alert October 2021 Deloitte New Zealand

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Real Estate Accounting Software Sage Canada

Gst On Flat Purchase And Real Estate Rates In 2022 And Impact On Home Buyers